Until now, it has been unclear whether you would need to link your Aadhaar Card with your PAN card. Now that the Supreme Court has upheld the linkage, all taxpayers will have to follow this new rule as of July 1, 2017.

The Aadhaar-Pan link status can be checked on the UIDAI website, and you can do it both manually as well as automatically via SMS, phone call or an API. However, here’s what you need to know about the Aadhaar-Pan link status, including how to complete the linking process.

What is an Aadhaar card?

The term Aadhaar is derived from two words in Hindi and Sanskrit, which can be translated into English as a foundation or base. An Aadhaar card is a plastic card that contains an individual’s demographic data and biometric information. The 12-digit unique identity number (UID) in your Aadhaar card was made available through UIDAI.

The Aadhaar card is now mandatory for a range of services from booking air tickets and making hotel bookings, to opening bank accounts and obtaining a mobile connection. What was once just an identification card has now become your passport towards seamless life in India.

What is a PAN card?

A pan card is a permanent account number (PAN) issued by the Indian income tax department that acts as a proof of identity and address. A pan card can also be called an Indian Taxpayer Identification Number (ITIN). Any person with a residence in India and who pays taxes in India must get a PAN.

- Well, it is mandatory to link your PAN card with your Aadhaar card. To link your PAN card with your Aadhaar, there are two ways you can go about it. The official and recommended way is to register on the government’s e-portal by providing your PAN and Aadhaar details. Once done, they will send a one-time password (OTP) on your registered mobile number, which you’ll need to key in on their website. Your PAN and Aadhaar cards will then be linked within 24 hours of submitting your application.

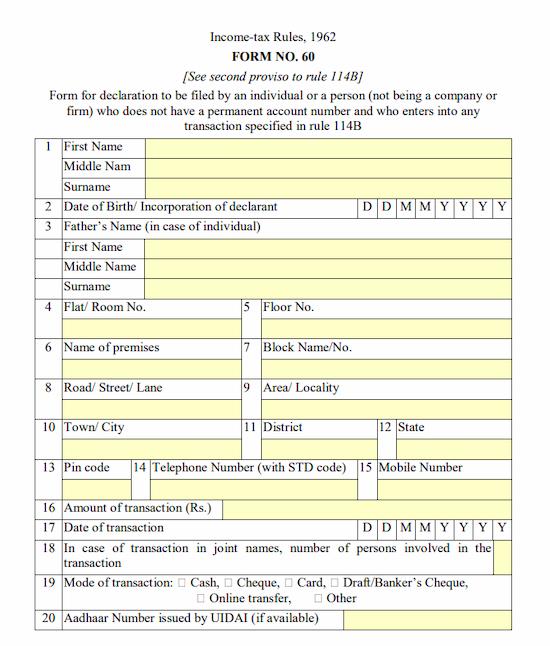

- However, if you don’t want to use that portal, or if it doesn’t work for some reason, you can download Form 60. Fill out all relevant details on page 1 of Form 60. On page 2, fill out your PAN card details and sign at the bottom. On page 3, fill out your Aadhaar card details and sign at the bottom. Send both pages along with copies of both PAN and Aadhaar cards to CPC, via post.

Aadhaar PAN link Status

Is your Aadhaar linked with your PAN card?

Then you can check it online. The Central Board of Direct Taxes has released a downloadable mobile app that enables taxpayers to verify their Aadhaar-PAN link status. This means those who have an Aadhaar number but have not yet linked it with their PAN card can do so by downloading an application and following a few simple steps.

Download Aaykar Setu App for iOS and Android

In fact, linking your PAN card with Aadhaar is mandatory if you want to file income tax returns in India. And while there are many ways to link these two important numbers—such as visiting a PAN service centre or calling up the Income Tax Department’s helpline—this new method could be especially convenient for people who don’t live near one of these centres or aren’t comfortable using phone lines.

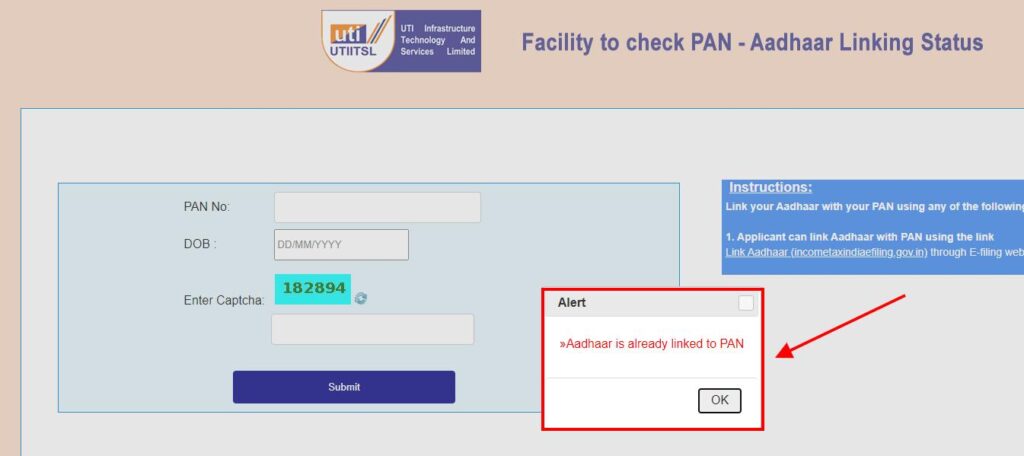

PAN Aadhaar Link Status Check Online

The Supreme Court upheld the Centre’s decision to make Aadhaar card mandatory for PAN, Income Tax returns and a host of other services. However, PAN is not a must for availing of social welfare schemes such as Pradhan Mantri Ujjwala Yojana, Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya), Ayushman Bharat Scheme etc.

Here’s how you can check your PAN Aadhaar link status online.

- Go to:

https://www.pan.utiitsl.com/panaadhaarlink/forms/pan.html/panaadhaar- Then you should enter your PAN card number and your date of birth also

- You can see a captcha there and you have to put it in the box

- Then click on the submit button

- The status of the linking will be displayed on the next screen.

Link PAN with Aadhaar

- if you hadn’t linked your aadhaar you must visit to:

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar- Here enter your Pan and Aadhar number and click on Validate

FAQs

No. You don’t need to show any other documents at the time of linking your Aadhar and PAN, except the Aadhar number and PAN.

Yes, there are options to check, verify and modify the details of your PAN through Protean eGov Technologies Limited portal. And using the official website of UIDAI, you can make changes to your Aadhaar card.

Yes, it is mandatory according to the announcement of the Ministry of Finance.