To make a profit in intraday trading the most important step is stock selection. Taking trade blindly in any stock can make your day worse. So, if you are a beginner and struggling in stock selection then our post on how to select stocks for intraday trading may help you a lot.

By selecting stocks for intraday based on the below-shared guides, you can increase your accuracy in intraday trading. Once your accuracy of making a profit increases then as a result your profit will also increase.

Various factors are involved in the stock selection to make your day profitable and increase accuracy in stock trading. These below shared key points are only good for intraday trading in stocks. For Index trading, many things remain the same but make sure you do not apply it.

Related Posts:

- What is Equity Trading? Understanding Equity Trading

- How to Start Trading in India (Scratch to Advance)

- 10+ Best FMCG Stocks for Long Term In 2024 – 2025

What is Intraday Trading?

Intraday trading is also popular by another name called day trading. In intraday trading, you must sell or buy stock on the same day and exit the position before the market closes. In intraday trading, you can buy or sell stocks, and ETFs, F&O, etc.

In case, if you do not exit your open position on the same day then most of your broken will automatically exit or close the position before 10 to 20 minutes of market closing.

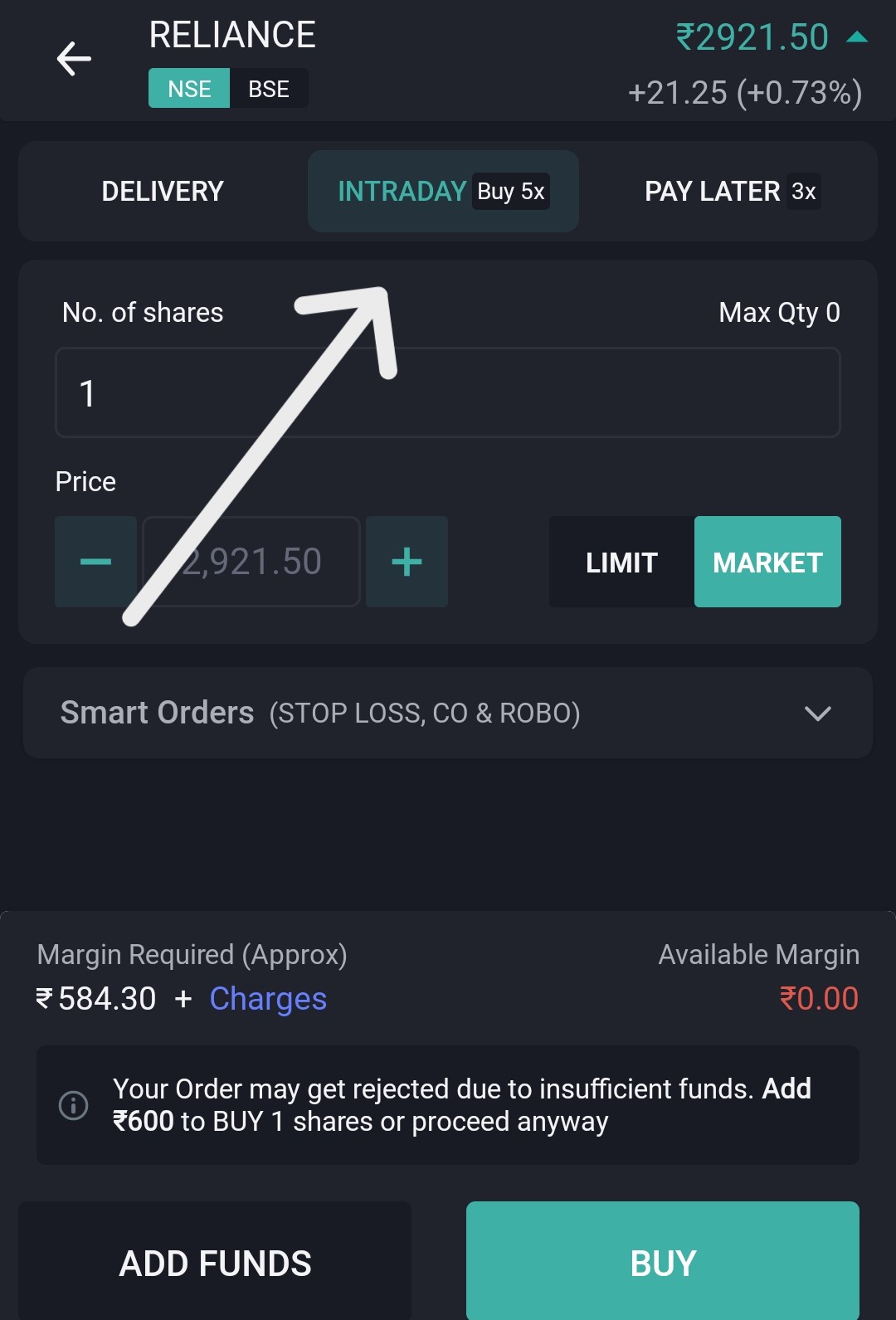

In Intraday trading, you’ll get a 5X margin for trading that helps a lot to take more trades even if you have less money. For example, if the stock price of Reliance is Rs. 3000 per share then you can buy it for Rs. 600 in Intraday. In some cases, the margin can be different for different stocks and it also depends on your broker app.

Note: The time to auto-exit the open intraday positions is different for each broker. Some brokers may also charge money if you do not exit the position before the market closing. So, ask your broker about it to save any extra charge on trading.

How to Buy and Sell in Intraday

Buying stocks or shares in intraday or delivery is a very simple and easy process. This section can be very helpful who just entered the trading world. If you know you can skip the section as well.

Note: There are a lot of best brokers in India and I’m using Kite by Zerodha to tell the process of buying and selling stocks Intraday. You can check the List of Top 10 Brokers in India.

- Step 1: Add stocks to the watchlist you want to buy or sell. You can also sell or buy stocks without adding them to your watchlist.

- Step 2: Once you added the stock, then click on the stock name you want to buy or sell.

- Step 3: After clicking, you’ll see a buy and sell button on your screen.

- Step 4: If you want to buy the stock click on the BUY button otherwise click on the SELL button.

- Step 5: After clicking on the Buy or Sell button, you’ll see a lot of options like quantity, price, intraday or carryforward, type, and many more.

Note: In the different brokers some option’s names can be different like Intraday is known as MIS and CarryForword is known as CNC or Longterm.

How to Select Stock for Intraday Trading

The intraday stock selection process is very easy and in most of the market conditions, the process remains the same. Once you understand the process with logic then you can modify it according to your trading setup and need.

Note: Below are many steps that are followed and recommended by the traders. In some cases, you need to avoid some below-shared points based on the market conditions.

1. Liquidity

You should always take trades in those stocks that are highly liquid because if you want to buy any specific stock at any level in high quantity then it can only happen in highly liquid stocks.

On the other side, if you try to trade in a stock in which liquidity is very low then it will become very hard to buy or sell the stock at a specific point.

Example. Suppose you want to buy ABCD stock for Rs. 100 in very high (large) quantity. While expecting an order at the MARKET price there is a very high chance you’ll get the stock at Rs. 102, 103, 104, etc. depending on the stock’s liquidity.

While exiting the position, you’ll probably be unable to exit the stock at the desired level or price.

There is one more issue that is if you place a limit order at any price then it may take a long time to execute or can not execute all the quantity.

Solution. You can trade almost all the stocks of NIFTY 100. In these stocks, you’ll get highly liquid stock where you can trade in very high quantities. In case, if you face any problem then you can go for NIFTY50 stocks.

2. Volatility

Volatility refers to the price movement of any stock. Low volatility stocks where the price moves in a range usually so, it becomes very difficult to trade and make money from these types of stocks.

So, to make money in Intraday trading you should choose the stocks where the stocks move which means their volatility can be medium to high.

It is easy to find medium to high volatility stocks, just trade in the NIFTY100’s stocks. So, your both steps i.e. Liquidity and Volatility will be solved without doing much.

3. Sector and Market Trends

Sector and Market trends also play a very important role in making very huge profit in intraday. If the market and sector trends are bullish then you should plan for buying. Conversely, if the sector and market trend is bearish, you should plan only for selling.

It is because, in most cases, stocks move in the same direction as the market. If the stock is strong or formed in any pattern then there are also possibilities that the stock can move according to the formed pattern. However, the effect of market trends can be easily seen in the stock.

So, to make money you should go with the trend. As a result, the market may also help to move the stock in the same direction.

4. Technical Analysis

Using the technical analysis you can very easily identify the trend of the stock and can predict where the stock can go. Technical analysis is a combination of many things like a chart, candle, support line, resistance line, trend line, etc.

You should select or trade in the stocks based on the technical analysis. With the help of technical analysis making money can be very risky and the probability of marking money also increases.

Note: You can not make money only with technical analysis, the risk management and psychology can help to make money. In a few words, you have to focus on technical analysis, risk or money management, and psychology at the same time.

5. Trading Strategy

If you don’t have enough knowledge to trade using technical analysis then you should try a trading strategy. With a trading strategy, it becomes very simple to take a trade and exit from the trade when the target or SL hits.

You have to just wait for a specific time, candle, indicator, etc. to take your trade. It depends on which trading strategy you are using.

Note: Taking trade blindly from any random strategy can burn your hard-earned money in a few days. So, while using any strategy make sure to backtest it. Once you get good results from the backtesting of the strategy then you can forward test it with a minimal quantity.

Making money with any trading strategy is simple but if you want to learn trading then you should go with the technical analysis. You may take some time to learn technical analysis but after learning it making a lot of money will be very simple.

FAQs

There are some very basic steps to select stocks for intraday trading i.e. liquid stocks, volatile stocks, stock’s sector trend, market trend, technical analysis, etc. Above we explained all the steps in detail.

There are hindered stocks that are best for intraday trading. But you have to filter the stocks based on your trading strategy and needs. For the high liquidity and volatility, you can go with Nifty 100 stocks.

It is very hard to share because traders make their strategies according to their needs, experience, and knowledge in the stock market.

Final Words: The post on how to select stock for intraday trading is very helpful for traders who are in the learning phase. These above shared intraday stock selection key points can make you very profitable if you avoid them while taking the trade in stocks.

Disclaimer: We are not SEBI registered and the below-given share target price by brokerage firms, analysts (share price forecast), and analysis by us is only for educational purposes, not any buying or selling recommendation. We will be not responsible for any profit and loss.