Crypto trading is gaining momentum in 2025. But at the same time, there is an increasing confusion about which platform you should opt for to start trading. If you select the right platform, then you can gain multiple advantages. Starting from safety to proper support, everything is key when it comes to trading.

In fact, you must also ensure that the platform you select offers you the latest features like crypto trading bots, advanced security, and multiple currency options. Among platforms offering reliable automation, BYDFi has emerged as a favourite for many.

So, let us understand what makes this platform a key choice among investors. Also, we will explore what makes the BYDFi bot the best crypto trading bot in 2025.

BYDFi Overview

One of the top platforms in the crypto trading segment is BYDFi. It was launched in 2020. Later in the year 2023, it was rebranded as BYDFi. Today, it’s a global crypto trading platform built for individuals who want more than just a place to trade.

When it comes to its positioning, it is known as a one-stop social trading hub/. It supports spot trading, perpetual contracts, copy trading, and advanced automation tools like Martingale and Grid bots. With its motto “BUIDL Your Dream Finance,” BYDFi aims to make digital asset trading accessible, efficient, and secure for users worldwide.

BYDFi is available in over 190 countries and trusted by more than 1 million users globally. Its intuitive interface, wide range of trading pairs (700+), and flexible leverage (up to 200x) cater to both new investors and seasoned professionals. The platform also features Proof of Reserves (POR) and dual MSB licenses in the US and Canada, reinforcing its focus on transparency and user asset protection.

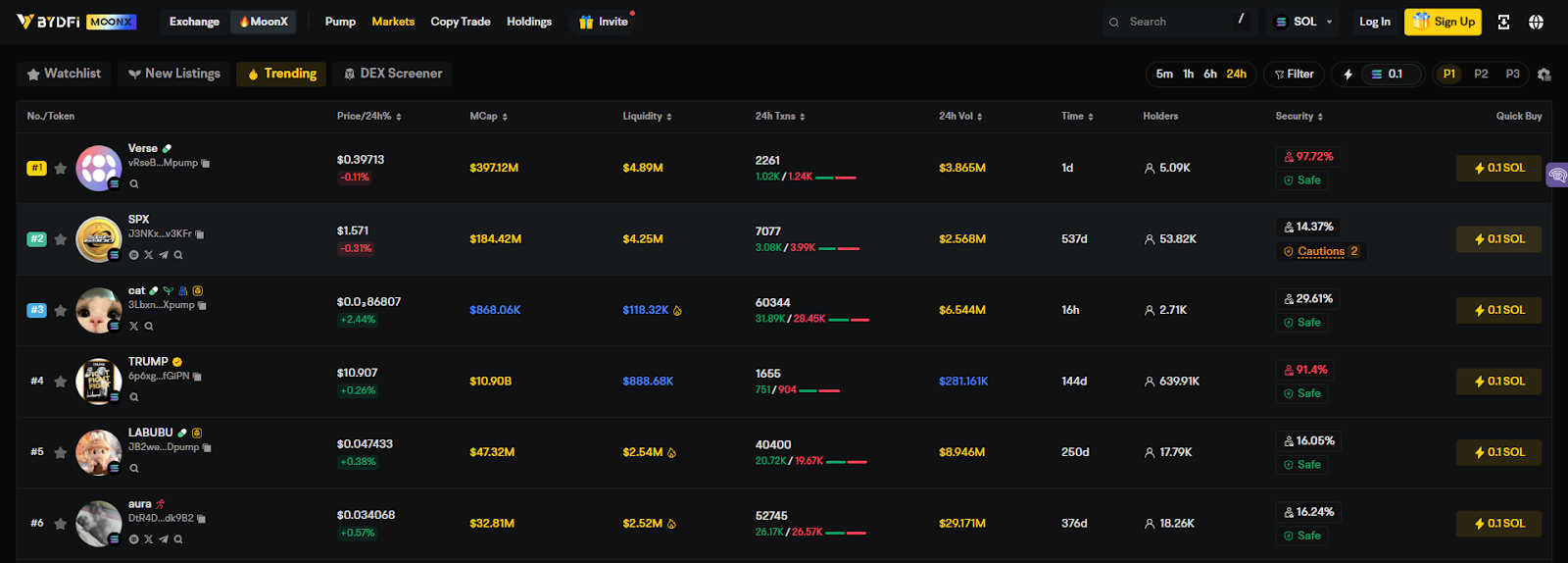

What sets BYDFi apart is its consistent innovation. In 2025, it launched MoonX, a Web3 on-chain trading tool designed to bridge centralised and decentralised trading. From real-time strategy bots to demo accounts with 50K USDT, BYDFi combines flexibility with performance. Its onboarding is simple, no mandatory KYC for most features, and new users can claim rewards worth up to 8,100 USDT through the Welcome Package.

Whether you’re trading Bitcoin, exploring memecoins, or testing strategies in a simulated environment, BYDFi gives you the tools, safety, and speed to stay ahead in today’s dynamic market.

Basic Details of BYDFi

| Feature | Details |

| Name | BYDFi (Build Your Dream Finance) |

| Type | Centralized Cryptocurrency Exchange (CEX) |

| Founded | 2020 |

| Headquarters | Aurora, Colorado, USA |

| Regulatory Status | Registered with FINCEN (US MSB), FINTRAC (Canada), and in Singapore, Seychelles |

| Supported Countries | 190+ (Not available in China, UK, Pakistan, Bangladesh, Kazakhstan, Iran) |

| Number of Cryptocurrencies | 700+ (including major coins and emerging memecoins) |

| Trading Products | Spot, Perpetual Contracts (up to 200x leverage), Copy Trading, Grid Bots |

| Fiat Support | 100+ currencies via providers like Banxa, Transak, Mercuryo, Alchemy Pay |

| Deposit Methods | Crypto, Credit/Debit Cards, Bank Transfers, Apple Pay, Google Pay, 3rd-party |

| Withdrawal Methods | Crypto, Fiat via third-party providers |

| Fees | Low maker/taker fees (Spot: ~0.1%–0.3%; Futures: 0.02% maker / 0.06% taker) |

| Daily Withdrawal Limits | Unverified: 1.5 BTC/day; KYC Verified: 6 BTC/day |

| User Base | 1 million+ users globally (as per the latest verified data) |

| User Interface | Beginner-friendly, supports advanced charting and bot tools |

| Recognition | Featured in Forbes Top 10 Crypto Exchanges (2023) |

| Website | www.bydfi.com |

Core Features of BYDFi

BYDFi is a platform that is designed to ensure that trader of every nature gets one of the other benefits. From the various trading options to the bots, there are various options that make this platform a great choice. Now, the core features why you should be opting for BYDFi are as follows:

1. Spot Trading With 700+ Cryptocurrencies

BYDFi allows you to invest in many cryptocurrencies. You can invest in assets like Bitcoin, Ethereum, Ripple, Dogecoin, Shiba Inu, and more, with over 700+ spot trading pairs available. This allows investors to opt for diversification, making this one of the best options. You also get the real-time charts, order book depth, and basic as well as advanced trading options.

2. Perpetual Contracts With Leverage Up to 200x

You can go for derivatives as well. BYDFi offers perpetual futures contracts with leverage ranging from 1x to 200x. This includes both USDT-M and Coin-M pairs. Traders can manage risk with isolated or cross-margin modes and take advantage of volatility in either direction, long or short. Few exchanges offer leverage at this scale, making BYDFi attractive to high-frequency and professional traders.

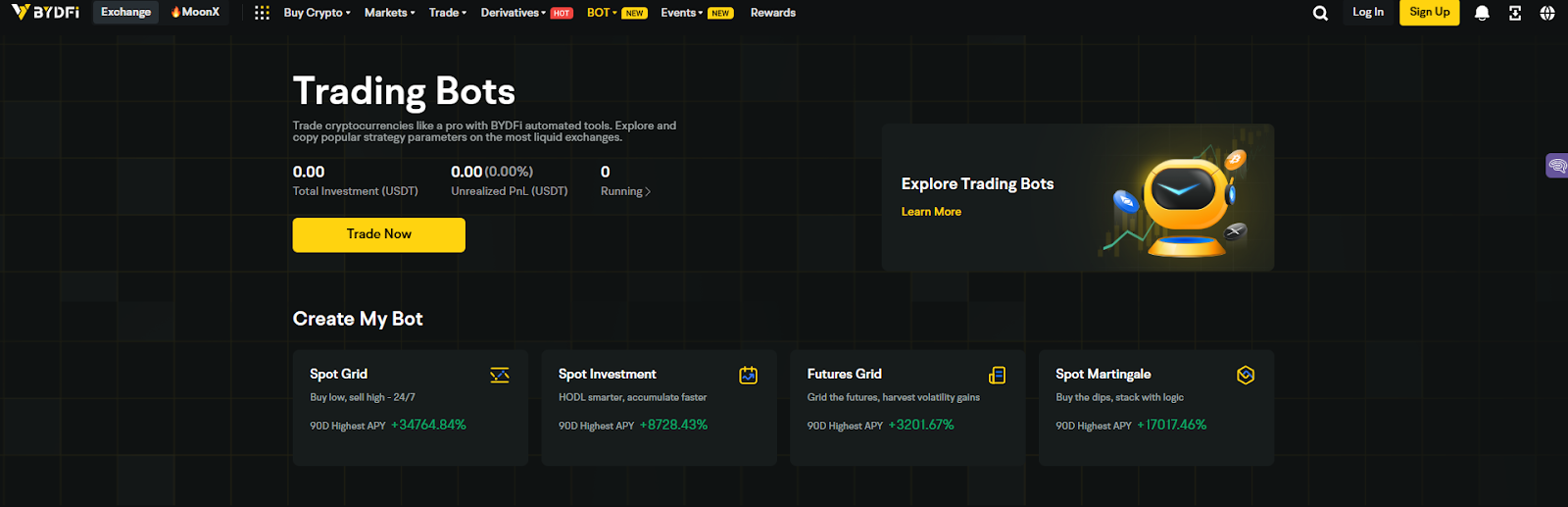

3. Built-In Trading Bots for Automated Strategies

The platform includes several automated tools such as spot grid bots, futures grid bots, Martingale bots, and spot investment bots. These allow users to automate trading based on market conditions. For example, a grid bot can buy low and sell high within a set price range, while the Martingale bot is ideal for cost averaging during downtrends. No coding is required, and the bots can be activated in minutes.

4. Copy Trading With Low Entry Requirements

BYDFi offers a simplified copy trading system that lets users follow top-performing traders. You can review their performance history. The best part is that you can start investing from as low as $10. So, this makes it a great option for beginners with proper exposure.

5. Free Demo Account for Learning and Practice

New users can access a demo account with 50,000 USDT in virtual funds. This acts as a practice trading account where you can try and learn. You can explore the features and even test the trading strategies. So, there is no risk for the real money as well. Gain confidence as well through this plan.

6. Fiat Gateway With Global Payment Support

BYDFi supports fiat deposits in over 100 currencies. You can do this with the help of third-party platforms like Banxa, Transak, Mercuryo, and Alchemy Pay. The option for using credit cards and online payment platforms is also there. This makes onboarding very simple.

7. Strong Security and Transparent Reserves

BYDFi applies top-tier security practices, including cold wallet storage, multi-signature approval, and withdrawal address whitelisting. It also publishes Proof of Reserves reports to assure users that all assets are fully backed. The platform holds regulatory registrations in the US and Canada, further enhancing its credibility.

8. On-Chain Trading With MoonX

Launched in 2025, MoonX is BYDFi’s Web3 trading tool that allows users to trade directly on-chain using wallets connected to Solana and BNB Chain. This marks BYDFi’s move into CEX + DEX integration. This allows the combination of the reliability of centralised exchanges with the freedom of decentralised platforms.

9. New User Rewards and Earning Opportunities

To make onboarding more rewarding, BYDFi offers a Welcome Package worth up to 8,100 USDT for new users. There is two-factor authentication as well. This all allows the users to be secure. Also, there are seasonal campaigns, referral bonuses, and trading competitions.

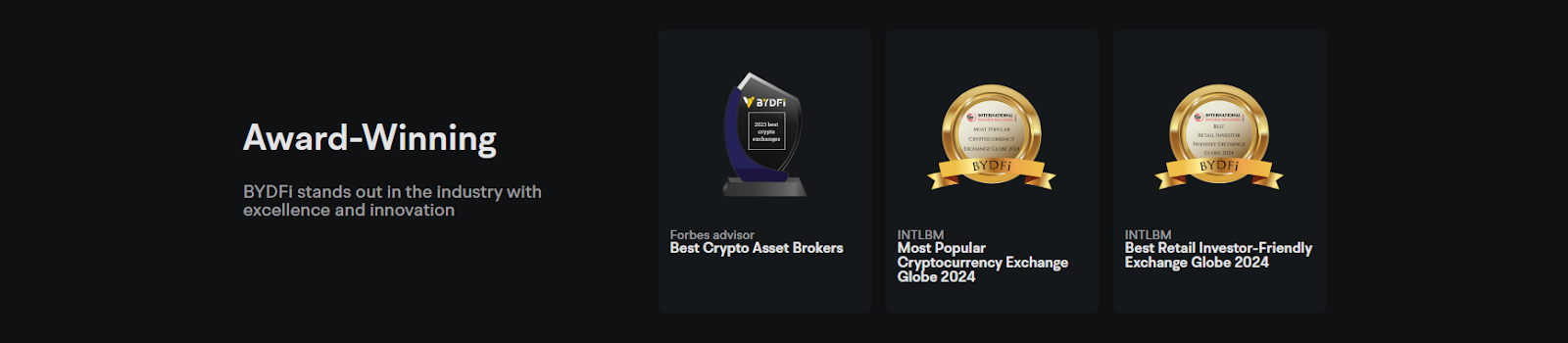

Awards and Recognition

BYDFi has consistently stood out. It is all because of the features and awards that it has gained. So, here are a few key insights to know:

- Forbes Advisor – Best Crypto Asset Brokers (2023): One of the best platforms that highlights its trustworthiness and performance.

- INTLBM – Most Popular Cryptocurrency Exchange Globe 2024: This award reflects BYDFi’s rapid growth and increasing preference among everyday crypto traders across the world.

- INTLBM – Best Retail Investor-Friendly Exchange Globe 2024: A testament to BYDFi’s intuitive design, low entry barriers, and focus on making crypto trading accessible to retail users.

- Coingape Ranking – 3rd Top Global Cryptocurrency Exchange: Recognised for its consistent performance and positive reputation among both users and industry experts.

- Listings on CoinMarketCap and CoinGecko: These official listings validate BYDFi’s trading volume. This guides them as a legitimate and transparent platform.

- Event Sponsorship – TOKEN2049 Dubai: This makes the BYDFi an active contributor in the global digital asset community.

- BYDFi Trading Championship: Known for setting an annual event that makes it a high-performance trading environment.

These awards and milestones reinforce BYDFi’s position as a reliable, innovative, and globally recognised exchange.

What Is the BYDFi Trading Bot?

The BYDFi Trading Bot is an automated trading tool built into the BYDFi cryptocurrency exchange. It helps users trade digital assets more efficiently by executing buy and sell orders based on pre-set strategies and parameters. This works on its own with no need for manual tracking regularly.

It is best for both beginners and experienced investors. It offers real-time market analysis, integrated risk management, and smooth trade execution, all within BYDFi’s user-friendly interface. It also offers you a chance to try demo trading with no real money.

By automating the trading process, the BYDFi bot reduces emotional decision-making and streamlines strategy execution. Whether you’re looking to capture small profits in sideways markets or run structured long/short strategies, this tool offers a practical and efficient way to stay active in the market with less effort.

Features of BYDFi Trading Bot

The BYDFi Trading Bot is aimed at making trading faster and smoother. With the help of both, investors can manage risks and ensure that market opportunities are captured.

Below are the key features that make the BYDFi Trading Bot a reliable choice for traders in 2025.

1. User-Friendly Interface

This is a beginner-friendly bot. It is very simple to use and can be easily adapted as well. You can get started quickly, and there are no issues with navigation as well.

2. Real-Time Market Data

With the help of the bot, you can gain access to the live market data. This will allow you to stay on track and avoid the fluctuations as well. This will avoid losses to a great extent.

3. Customizable Strategies

If you are trying multiple strategies, then this is the best. You can work on various combinations to see which suits you best. This flexibility ensures that strategies match individual goals and preferences.

4. Automated Execution

Once the bot is configured, it carries out trades automatically based on the selected strategy. This removes the need for constant monitoring and helps maintain consistency in trading.

5. Robust Risk Management

The platform includes tools such as stop-loss, take-profit, and margin controls. These features help protect investments and manage risk effectively in changing market conditions.

6. Copy Trading Integration

There is an option to copy the strategies of experienced traders as well. This will reduce the chances of mistakes and ensure better results.

7. Demo Account Support

The demo account can be linked with the bot. This will help in testing and checking which strategy works best.

8. Advanced Charting and Technical Analysis

The platform offers a range of charting tools and indicators. This is quite helpful in managing and changing plans as per real-time analysis.

9. Strong Security Measures

BYDFi ensures the safety of user assets with encrypted API keys, two-factor authentication, cold storage, and secure wallet systems. These features are supported by additional safeguards such as multi-signature protocols, whitelisted withdrawal addresses, and AWS cloud infrastructure.

To build greater trust and transparency, BYDFi also follows a Proof of Reserves (POR) mechanism. This system allows users to verify that their assets are fully backed and securely maintained on the platform. Regular updates and verifiable records ensure that user balances are auditable, helping maintain financial integrity and platform credibility.

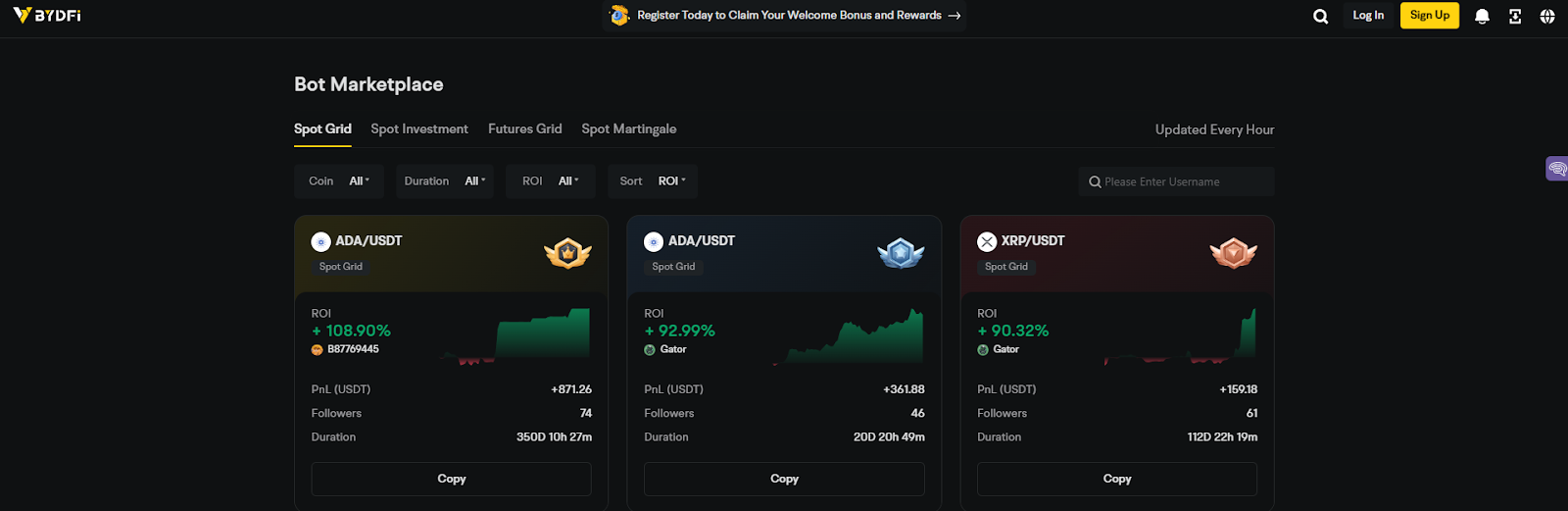

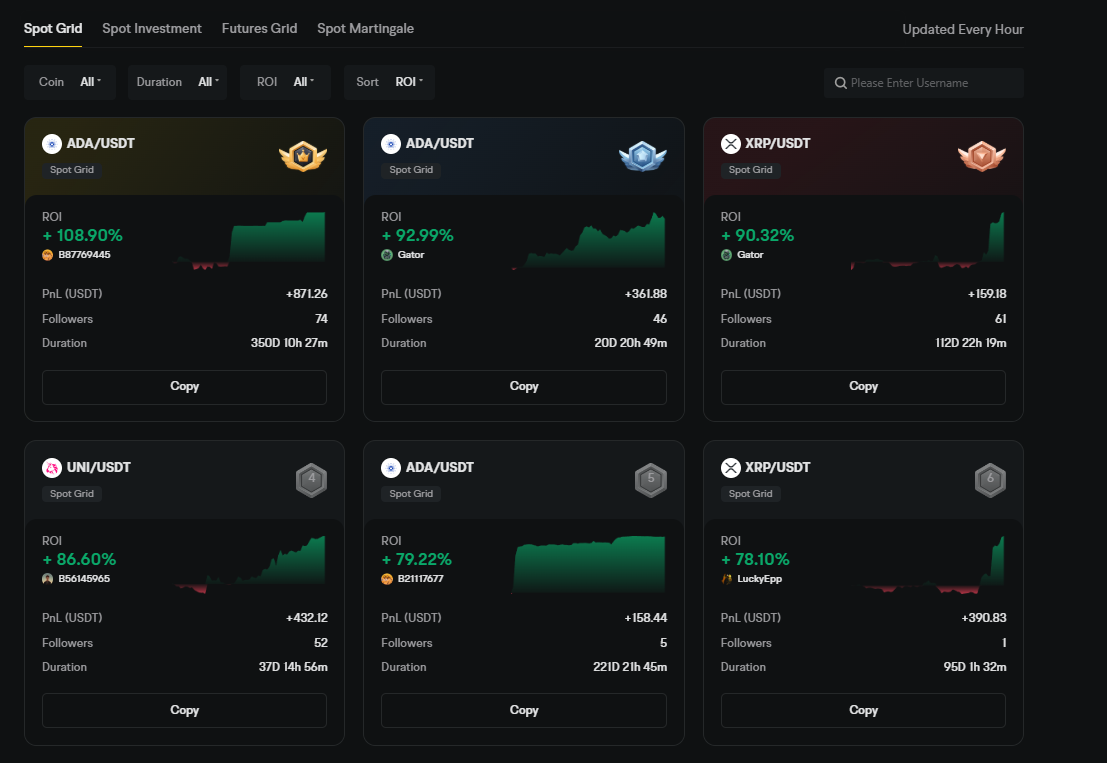

Types of Trading Bots on BYDFi

BYDFi offers four major types of trading bots, each designed for a specific strategy or market condition. Whether you want to trade in a sideways market, automate futures trades, manage volatile price drops, or build a long-term investment, there is a bot to match your goal. Below is a detailed breakdown of each bot, along with its pros and cons.

1. Spot Grid Bot

The Spot Grid Bot is designed for markets that move within a defined range. It automatically places a series of buy and sell orders at regular intervals above and below a set price. As the price fluctuates, the bot buys when it drops and sells when it rises, aiming to profit from every swing.

Pros

- Ideal for sideways markets

- Generates steady, small profits through automation

- No leverage is involved, making it safer for beginners

- Requires minimal monitoring once activated

Cons

- Not suitable for strong upward or downward trends

- May stop performing if the price breaks out of the set range

- Requires users to define a reasonable price range in advance

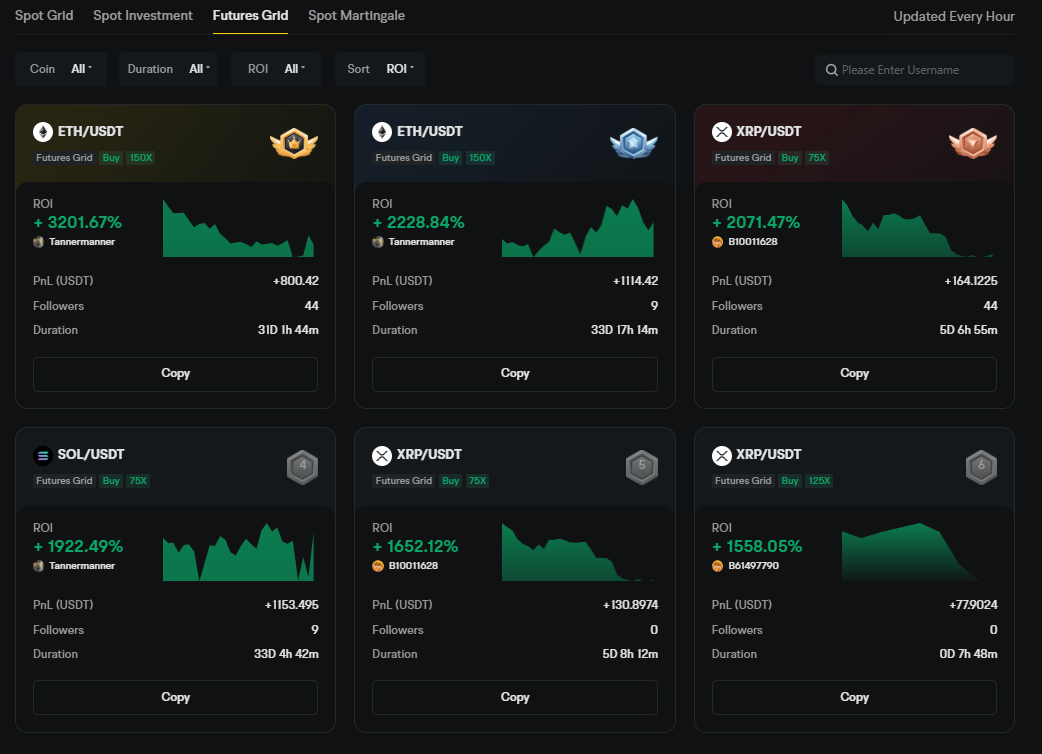

2. Futures Grid Bot

This bot applies grid trading logic to futures contracts. It allows users to choose leverage, go long or short, and set a price range within which the bot will buy and sell contracts automatically. It is useful for profiting in both trending and volatile markets.

Pros

- Works in both bullish and bearish trends

- Leverage can boost profits when used wisely

- Fully automated futures trading strategy

- Offers flexibility to trade in either direction

Cons

- Higher risk due to leverage

- Can lead to liquidation if the market moves sharply

- Requires a better understanding of margin and futures trading

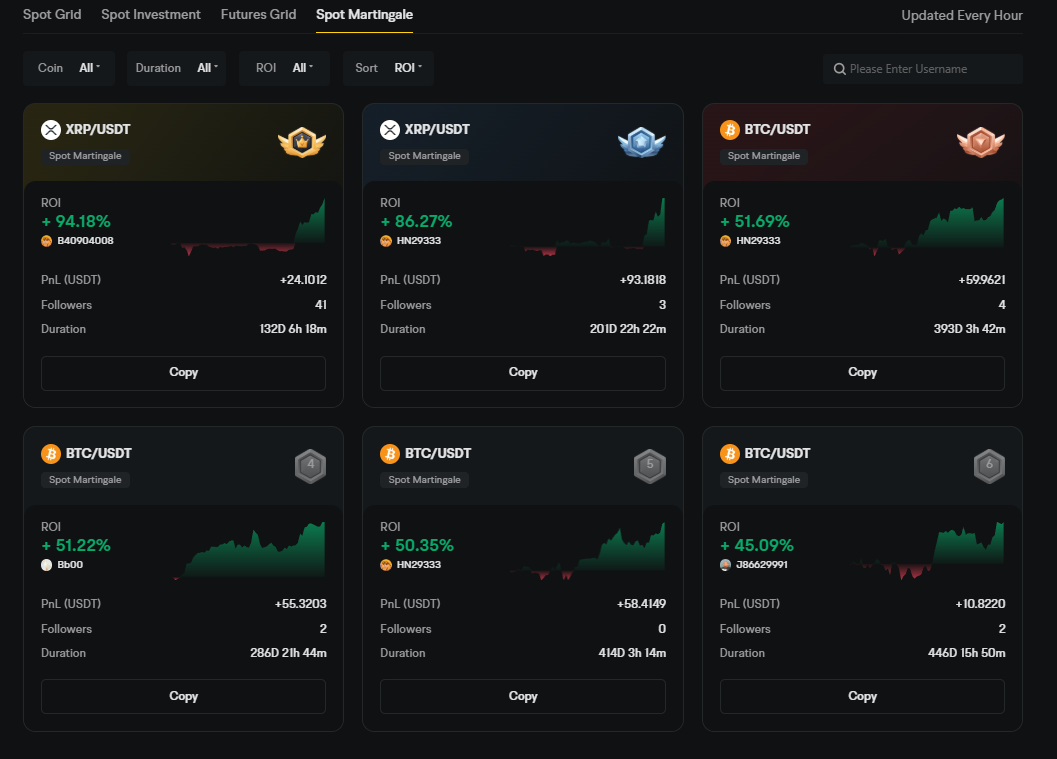

3. Martingale Bot

The Martingale Bot is based on a high-risk averaging strategy. When the price of an asset drops, the bot increases the position size to reduce the average buy price. The aim is to make a profit once the price rebounds.

Pros

- Effective in volatile markets with frequent recoveries

- Averages down cost, improving chances of profitable exit

- Simple to deploy and fully automated

- Can produce high returns if the market bounces back

Cons

- Very risky during sustained downtrends

- Uses increasing amounts of capital to stay active

- Poor fund management can lead to large losses

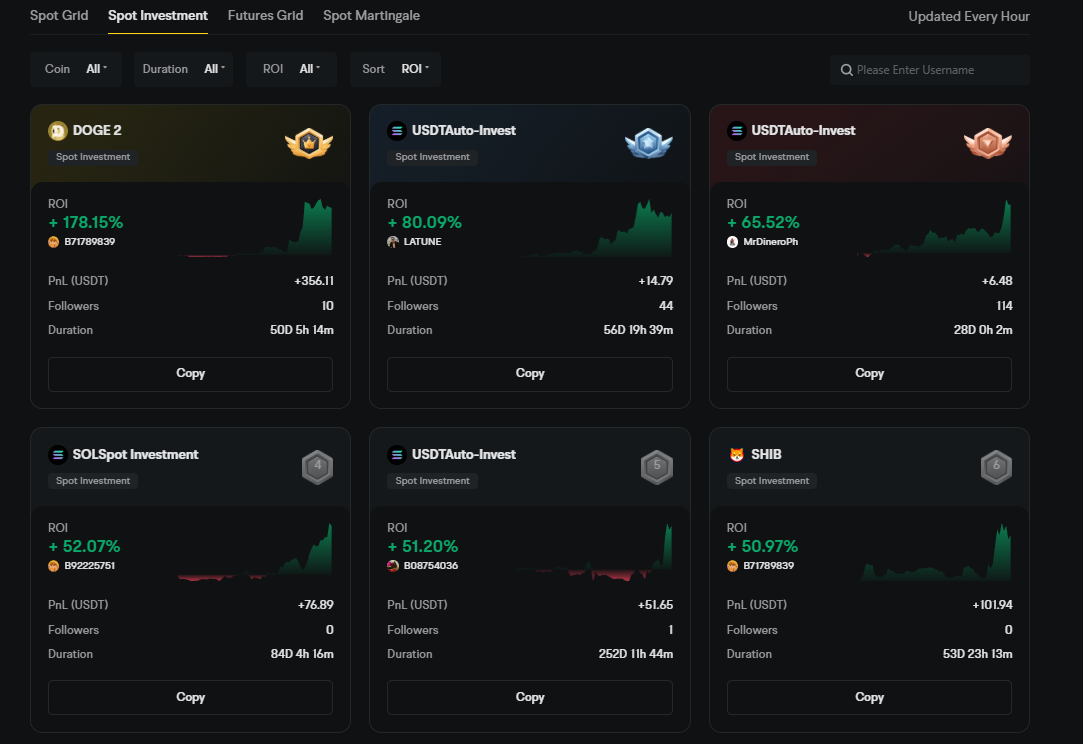

4. Spot Investment Bot

This bot is designed for long-term accumulation. It helps users invest in selected cryptocurrencies by automating periodic purchases. It follows a cost-averaging method, ideal for users who believe in long-term crypto growth.

Pros

- Best for long-term investors

- Reduces emotional buying and selling

- Easy to set up and completely hands-off

- Protects against volatility by averaging purchase prices

Cons

- Not ideal for short-term profits

- Gains depend on long-term market growth

- May lag behind active strategies in bullish markets

BYDFi Trading Bots: Comparison Table

| Bot Type | Key Focus | Ideal Market Condition | Best Suited For |

| Spot Grid Bot | Buy low, sell high within a set price range | Sideways or range-bound markets | Long-term holders, beginners, and cost-averaging strategy followers |

| Futures Grid Bot | Automate leveraged long/short trading | Trending or volatile markets | Experienced traders, users familiar with futures and margin |

| Martingale Bot | Average down during price drops | Volatile markets with price rebounds | High-risk traders, aggressive investors with capital flexibility |

| Spot Investment Bot | Passive, long-term accumulation strategy | Gradual upward or volatile markets | Long-term holders, beginners, cost-averaging strategy followers |

Why Investors Are Choosing BYDFi’s Trading Bots in 2025

In 2025, automation will no longer be just a tool for advanced traders. It has become essential for anyone looking to stay competitive in the fast-moving crypto market. BYDFi has responded to this need by offering a powerful yet accessible range of trading bots that cater to all kinds of investors. Whether you are a beginner who wants to automate simple strategies or a professional looking for flexible and data-driven tools, BYDFi makes it easy to get started.

Here are the key reasons why more investors are choosing BYDFi’s trading bots to manage and grow their portfolios:

-

Plug-and-Play Simplicity

You don’t need coding skills or complex setups. Users can select a strategy and then, based on the same can decide which biot to go for. The simple interface makes it easy to use and offers great options.

-

Strategy Variety

BYDFi offers a wide range of bot types, including grid trading, DCA (Dollar Cost Averaging), arbitrage strategies, and AI-assisted configurations. This flexibility allows users to pick a strategy that matches their market view and risk profile.

-

Multi-Asset Support

Bots can be deployed across various trading pairs. You can easily use the bit for top assets like BTC, ETH, and SOL. Users can manage multiple bots under one platform without switching interfaces or tools.

-

Performance Insights

Each bot provides real-time data on ROI, trade history, and performance trends. This transparency helps users track success, adjust settings, and make informed decisions as markets evolve.

-

Low Latency Execution

Thanks to BYDFi’s high-speed infrastructure, trades are executed with minimal delay, even during high market activity. This ensures that every opportunity is captured efficiently.

All these make the BYDFi bots the best choice in 2025.

Get Started in 3 Easy Steps

Setting the BYDFi bot is really easy. You just need to follow the steps mentioned below:

Step 1: Sign In to Your BYDFi Account

Visit bydfi.com and log in to your account. If you’re new to the platform, you can create an account using your email or phone number. There is a flexible KYC policy.

KYC is not immediately required for basic access and core functions. However, completing KYC is necessary if you wish to increase your withdrawal limits or unlock advanced features. This approach makes the platform easy to use while ensuring compliance when needed.

Step 2: Go to the Trading Bot Section

Once logged in, navigate to Strategy Trading and select Trading Bots from the menu. You’ll see the available bot types, including Spot Grid, Martingale, and Futures Grid.

Step 3: Configure and Activate Your Bot

Choose your preferred bot, select a trading pair, define your parameters such as price range, investment amount, and grid size, then activate it.

That’s it. The bot will immediately begin monitoring the market and executing trades on your behalf, completely automated, with full control in your hands.

Conclusion

Crypto trading is evolving, and so are the tools investors rely on. In 2025, automation is not just a trend; it’s a practical way to trade smarter. BYDFi’s trading bots simplify this shift by offering easy setup, flexible strategies, and real-time execution for users at every level.

Whether you’re aiming for consistent gains in sideways markets, managing risk in volatile conditions, or building long-term positions without daily effort, BYDFi gives you the structure to do it with confidence. With built-in support for different strategies and a platform that puts control in your hands, it’s clear why more investors are turning to BYDFi to handle their trading, day and night.

If you’re looking for a way to stay active in the market without constantly reacting to it, BYDFi’s trading bots offer a strong starting point.

Disclaimer:

The content provided in this article is for informational purposes only and does not constitute financial advice or a recommendation to trade or invest. Cryptocurrency trading involves risk and may not be suitable for all investors. Always conduct your own research and consult with a certified financial advisor before making any investment decisions. The mention of BYDFi or any trading bot is not an endorsement. Use such platforms and tools at your own discretion and responsibility.