Disclaimer:

The information provided in this article is for informational and educational purposes only and should not be considered financial or investment advice. Investing in the stock market involves risks, including the potential loss of principal. Gambling-related stocks may carry higher volatility and risk due to regulatory, ethical, and market uncertainties. We do not guarantee the accuracy or completeness of the information presented. Readers are strongly encouraged to conduct their own research or consult with a licensed financial advisor before making any investment decisions. Past performance is not indicative of future results.

Whether you’re a seasoned investor or just starting to explore new opportunities, keeping an eye on emerging trends and being open to investing in a diverse range of stocks can make all the difference. One sector that’s gaining serious momentum? Gambling and betting.

With the global betting industry projected to surge past $150 billion in the next few years, now might be the perfect time to explore opportunities in this fast-paced, high-reward sector. From digital betting platforms to traditional casino operators, the market is evolving rapidly, fueled by loosening regulations, tech innovation, and rising consumer demand. But with high growth potential comes volatility, and picking the right stocks is key.

If you want to read experts’ thoughts, here’s what Dr Pauline Lemar, Mathematician and Data Analyst of NoDepositFriend.com, had to say: “Gambling stocks can be unpredictable, but those tied to scalable digital platforms with strong data infrastructure are showing the most resilience and long-term value.”

So, let’s dive into our Top 10 picks for 2025.

1. Las Vegas Sands

A top choice for investors seeking greater exposure to the lucrative Asian market, LVS operates five casinos in Macau and the Marina Bay Sands in Singapore. The company saw a massive rebound in 2023 after pandemic-related slowdowns and is beginning to dip its toes into digital gaming through strategic investments.

2. MGM Resorts

MGM owns iconic Las Vegas properties like the Bellagio and MGM Grand, along with a significant stake in MGM China, giving it strong exposure to the booming Macau market. Its online arm, BetMGM, continues to expand across U.S. states. MGM also secured a new 10-year operating license in Macau, reinforcing its long-term regional presence.

3. DraftKings

DraftKings remains a major player in U.S. online betting, with over 3.5 million monthly paying users. The acquisition of Golden Nugget Online Gaming has helped expand its reach. Though still operating at a loss, DraftKings saw 70% revenue growth in 2023, making it a high-risk, high-reward option.

4. Flutter Entertainment

Flutter is the parent company of FanDuel, one of DraftKings’ top rivals in the U.S. online betting market. It also owns global brands like PokerStars and Paddy Power. Flutter’s multi-market presence and strong brand recognition make it a diversified play in online gambling

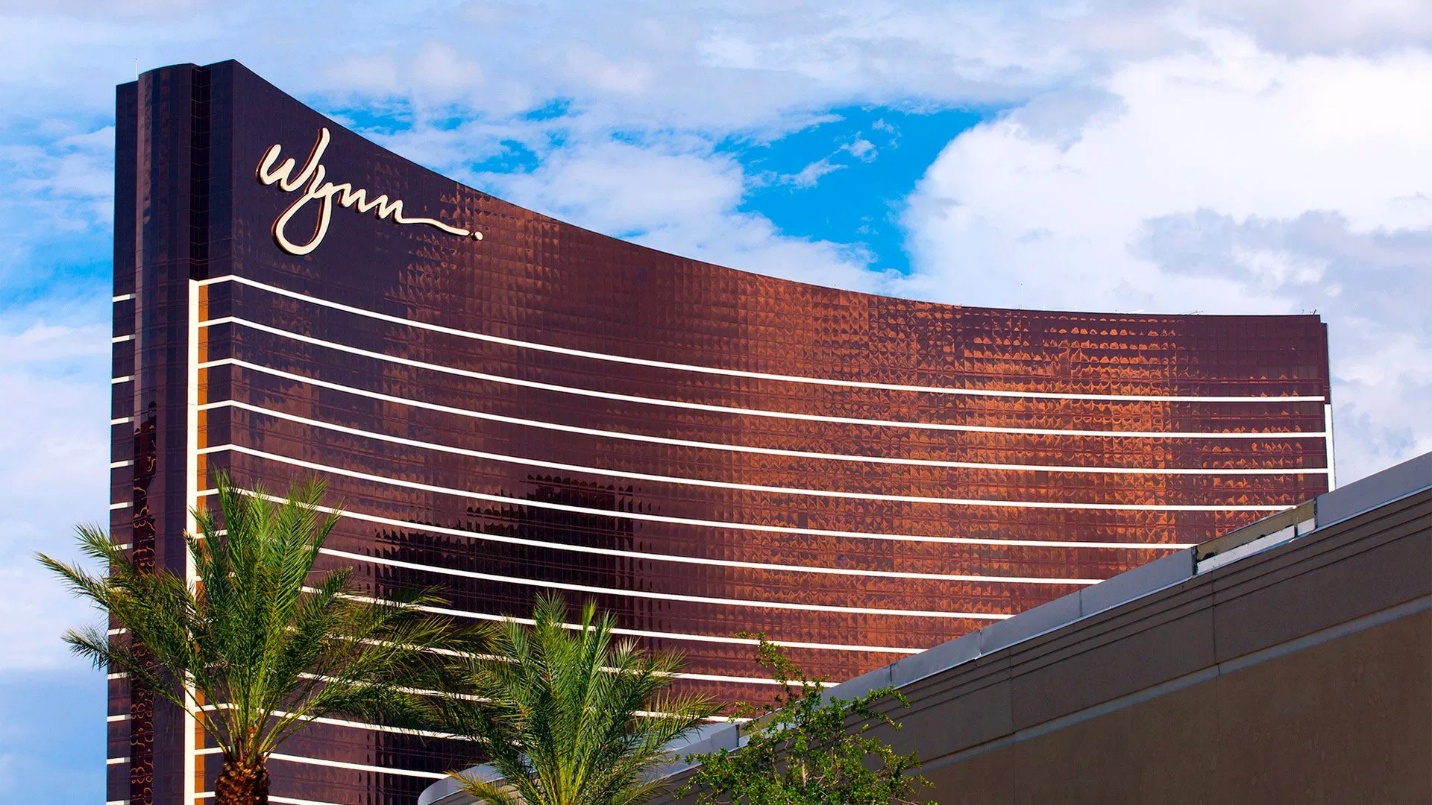

5. Wynn Resorts

With luxury resorts in Las Vegas, Boston, and Macau, Wynn is a global name in high-end gaming. While its digital segment has faced challenges, Wynn reported $6.5 billion in revenue in 2023 and is preparing to enter the UAE market with a new resort in Dubai by 2026.

6. Penn Entertainment

Penn operates 44 gaming properties in 20 U.S. states and has shifted its focus to online gaming with the ESPN Bet app, which was developed in partnership with Disney. After rebranding Barstool Sportsbook, Penn aims to boost market share through acquisitions and its growing digital ecosystem.

7. Caesars Entertainment

Post-merger with Eldorado in 2020, Caesars is now the largest casino operator in the U.S., owning 54 properties. Its acquisition of William Hill has accelerated its entry into digital sportsbooks, though the bulk of revenue still comes from physical locations.

8. Entain PLC

Entain owns betting brands like Ladbrokes and bwin and is BetMGM’s 50/50 partner alongside MGM Resorts. The company has a strong focus on digital transformation and operates in over 20 markets worldwide, offering both diversification and scale.

9. Evolution AB

Sweden-based Evolution is a global leader in live casino software, providing streaming-based table games to dozens of online casinos. As online casinos grow in popularity, Evolution’s B2B model and innovative tech give it high-margin, scalable appeal.

10. Rush Street Interactive

A smaller-cap option, RSI operates the BetRivers and PlaySugarHouse platforms in several U.S. states and Latin America. While not yet profitable, its focused expansion strategy and strong brand in second-tier markets could pay off as the online betting space matures.

In short, the gambling industry has evolved beyond the slot machines and poker tables of yesteryear. With increasing digital adoption, global expansion, and the convergence of entertainment and tech, this sector is brimming with potential for savvy investors.

So whether you’re after growth, income, or international exposure, there’s a stock to match your investment goals. With that being said, it is important to remember that volatility is part of the game when it comes to investing. So be sure your research, diversify your portfolio, and never invest more than you’re prepared to lose.