Introduction

Back in the old days, people had to do everything manually. For instance, what would you have to do if you were to keep a record of product sales daily in the past?

You would probably have to take a pen and a register to make a listing and then manually calculate your daily revenue and profit.

That is where the power of technology can be felt. Today, even ordinary software like Excel is a hundred times faster, easier, and more manageable than manual listings. To step up the game, there also are several helpful, dedicated software for small businesses and startups.

To make it easier for you to pick the best payroll software for your small businesses, this article provides a complete guide.

Here, some top picks, along with their pros and cons, are explained for your ease.

Let’s see the options and select the best payroll software to streamline your daily payroll processes.

Is Leveraging a Payroll Software Worth It?

Yes. To compete in the market, what do businesses have to do?

They must focus on their product, quality, money-saving ways, dealings, etc. These are the vital things that most big businesses value to grow a more extensive clientele. But to have all the efforts dedicated to these vital aspects, it is necessary that they have a tool to manage other routine tasks.

These tasks could be anything like managing your accounting, garnishments, tax-related processes, attendance reports, adding new employee data, etc. Instead of wasting your brain and energy on these never-ending repetitive tasks, what you must do is let payroll software manage them. This will take a significant portion of your work off your plate.

So, instead of racking your brain, you can focus on something else that is more vital to the business. Before going straight into the list of best payroll software, let’s first see the methodology for shortlisting.

15 Best Picks on Payroll Software Packages

1. OnPay Payroll

If you are searching for the best payroll software for small businesses based on the best value, OnPay Payroll is the go-to software. While designed for small businesses, it can also tackle large ones like restaurants, farms, etc.

This payroll software is super easy to use. It features updating personal records, automatic tax payments, requesting time off, self-service for onboarding, PTO tracking, etc. You can also manage retirement and insurance plans.

2. ADP RUN

ADP RUN cannot go unmentioned when talking about payroll software because it is the most trusted globally. Along with customer support features for your business, this payroll software can easily manage any business with more than 1000 employees.

An employee can use its mobile solution to access a retirement account and manage health insurance services. It also features automatic tax filing, reporting, training programs, employee handbooks, add-ons for legal assistance and marketing, etc.

3. Gusto Payroll

It’s another best payroll software based on overall capabilities. This payroll software allows you to automate many processes with unlimited payroll runs. Plus, employees can download its mobile app to view their finances and get payments through debit cards.

Along with contractor-only plans, Gusto Payroll is integrable with many accounting apps, including FreshBooks, QuickBooks Online, etc.

It also features an automated charitable donation system, and employees can get a digital wallet for increased control of their money.

4. QuickBooks Payroll

It’s an excellent payroll software and is the best pick for an integrated solution. For every small business already using QuickBooks online, shifting to the full suite of features is a logical decision. It does not just offer an automated tax filing system, same-day direct deposits, an HR support center, etc.

It even offers management of garnishments, a personal HR advisor, next-day direct deposits, and a tax-penalty-free guarantee. Plus, employees can access personal information and pay stubs.

5. Patriot Payroll

With a low cost, Patriot Payroll is the best payroll software compared to others. The cherry on the cake is that it also offers a 30-day free trial. It features tax filing with guaranteed accuracy with add-ons for HR to streamline attendance tracking.

If you are currently using QuickBooks, Patriot Payroll can be integrated easily both online and on desktop versions. It is a good payroll software for price-conscious businesses.

6. Roll by ADP

Payroll with this payroll software is as easy as sending a text. It is backed by ADP, the largest payroll company in America. It was the first chat-based payroll system.

It features garnishments, automatic deductions for retirement plans, new hire reporting, real-time AI-driven error checks, a pay system for W-2 and 1099 workers, unlimited live chat support, and much more.

It also offers Google and Apple sign-on with Proactive task and deadline reminders.

7. Wave Payroll

Wave Payroll is an affordable payroll software with a free trial of 30-days. With this at your doorstep, you can effortlessly create professional invoices and track your expenses and income with bookkeeping coaching. With built-in bookkeeping, banking is super easy.

You can accept online bank payments and credit cards too. Employees can access their pay stubs, personal banking information, and W2s. Plus, you can see a breakdown of your payroll expenses by employee, expense type, and more.

8. Justworks

To run a business with confidence, this is the best payroll software for startups. With Justworks in your hand, you can ditch spreadsheets and many other repetitive tasks. You will get seamless online onboarding, pre-built reports, PTO management, and more with its fully-integrated HRIS.

The employee can enroll online, and you won’t need any paperwork. Employees can also access their time off information, health insurance, pay stubs, etc., even after office hours.

9. Paychex Flex

Paychex Flex can handle businesses of any size. It can automatically calculate local, state, and federal taxes. It has a unique appeal as it offers free articles and podcasts focusing on best HR practices.

To keep employees up-to-date, it also offers e-Learning modules. Paychex has 24/7 customer service, and you can work with a live specialist too. Being able to integrate with a large variety of this-party software, it is the best payroll software.

10. TriNet

For HR outsourcing, it is the best professional employer organization (PEO). You will lease the employees to TriNet, and TriNet will do all the HR-related heavy duty for you. It is an entirely hands-off HR and payroll system.

It significantly reduces many of your liabilities and processes. If you do not want all those HR and payroll processes to rack up your brain, TriNet is the best option to get started.

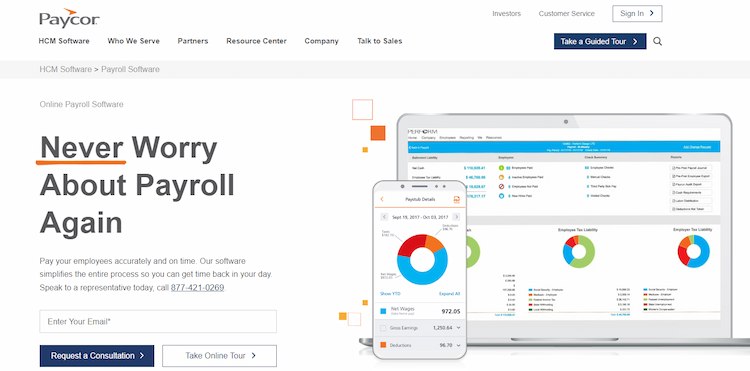

11. Paycor Payroll System

Paycor is another excellent payroll software in the tier of smart payroll solutions. It offers in-product compliance feedback to reduce risk. Besides a tax filing system, you can pre-schedule payroll cycles and receive alerts on your mobile app.

With a free trial feature, you can feel the power of self-service with Paycor. You also get tools for recruitment and performance reviews. You can save time significantly and have customized reports per your needs.

12. Rippling

Consider Rippling if you are looking for the best payroll software for small businesses. It is so powerful that it can run itself. It stores all of your business’s HR data, so you won’t have to do manual tasks.

Just hit the Run button and let Rippling do the work. It can handle all of your compliance work ranging from I-9s to W-2s. This ensures your company complies with the laws. Plus, you can effortlessly track PTO and hourly work.

13. Payroll4free

Another great payroll software on the list is Payroll4free. It gives an employee portal with detailed reporting and a step-by-step account setup tool. They can even reprint their pay stubs, review their accrued vacation time, update personal information, etc.

You can track an employee’s PTO, sick, and vacation time. It also allows you to export payroll data to several software products or companies.

14. Square Payroll

Square Payroll is an all-in-one payroll software with automated tax filings, full-service payroll, and employee benefits. It features custom reporting, tip and commission importing, multiple pay rates, unlimited bonus and off-cycle runs at no extra charge, calculated pay for new hires and terminations, and generates files and mail 1099s at year-end. It offers Quarterly filings, Internal Revenue Service, Yearly filings and forms, and Multistate payroll.

15. Zenefits Payroll

The final payroll software is Zenefits Payroll. This will improve productivity as features like signing documents, self-onboarding, and selecting benefits are entirely online without any administrative distraction.

With this advanced software, you can avoid several human errors that could be fatal to your business. It automates many of the compliance tasks and government filings for you. It also features safeguards to prevent accidental mistakes and a compliance calendar to never miss important deadlines.

Conclusion

Payroll software can save you a lot of trouble and time. With effective use of time, you can focus on vital aspects of the business. To help you pick the best payroll software for your small businesses, we presented a list of the best payroll softwares. You can choose one of them as per your requirement.